Annual Return Filing in India - Form D1

CliniExperts is a 360-degree regulatory solutions provider with over a decade of experience. Our highly updated team create a smooth experience in receiving necessary licenses and approvals.

Annual Return Filing in India – & submission and approval Form D1 – Overview

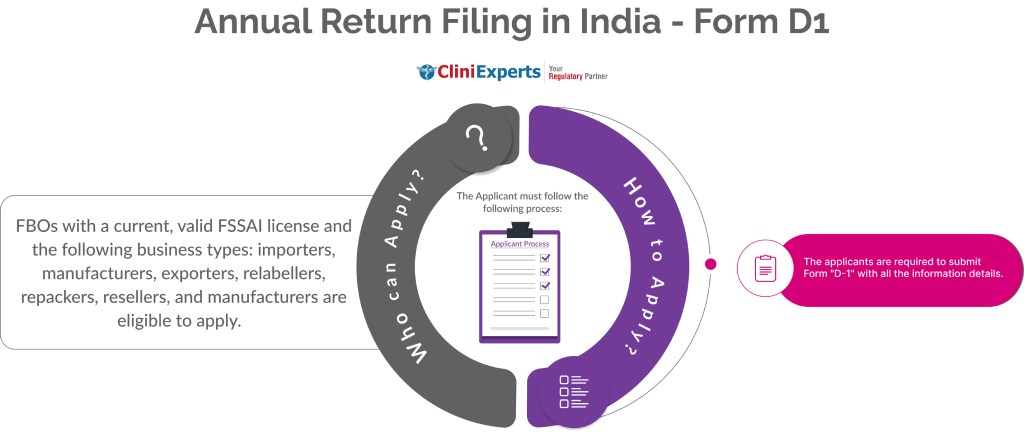

Who Can Apply?

FBOs with valid FSSAI license including importers, manufacturers, exporters, relabellers, repackers, resellers can apply.

How To Apply?

The Applicant must follow the following process:

-

The applicant is required to submit Form "D-1" with all the information.

Validity

The annual return is valid for 1 financial year, i.e., from 1st April to 31st March.

Fee Involved

No fee is charged by the government. However, there is a penalty of Rs. 100 per day for failing to submit annual returns.Important Documents

The documents mentioned below should be presented during the documentation process:

- Product Name/Nature

- Business Type

- Production Volume

- Sales Value in the previous financial year, etc.

- For a thorough checklist, please check the following websites:

- FORM D1: https://foscos.fssai.gov.in/assets/images/Annual_Return_Format.png

- Importer: https://foscos.fssai.gov.in/assets/images/AnnualreturnImporter.png

- Exporter: https://foscos.fssai.gov.in/assets/images/exporter.png

Timeline to get

Form D1

from FSSAI

Essential Tips

The primary considerations that need to be made while submitting this application are:

- FBOs are required to submit their annual returns for the preceding fiscal year by May 31st.

- The authorities will not accept an offline (physical or mail-in) submission of the annual return. FBOs can only use the FoSCoS portal to electronically file their yearly returns.

- Accurate information should be provided for the application. For products that were not manufactured in the preceding fiscal year, a nil return must be filed.

- The obstacles or issues that are most likely to arise when filling out or applying are:

- Before seeking to have their licenses renewed, FBOs must pay the penalty assessed for late filing of their annual returns. The penalty can be up to a maximum of five times the annual license cost.

- If an FBO neglects to file their annual return, they will be subject to a severe penalty that can be up to five times the annual license price.

- It can be challenging to manage the annual statistics for the goods produced in the preceding financial year.

Expert Advise

According to the experts, clients should look out for the following during the application procedure:

To avoid paying severe fines and to facilitate the easy renewal of FBO licenses, provide a periodic yearly return by the 31st of May of each year.

Food firms must comply with FSSAI standards and preserve transparency in their business. This is ensured by filing the Annual Food Business Return.

Periodic yearly returns can be filed by FBOs with state or central FSSAI licenses. Currently, distributors, wholesalers, storage providers, and transporters are not required to file an annual return.

Related Services

FSSAI Food License Registration (Form C)

Importer/Manufacturer | Regulatory Body: FSSAI

Grab your FosCos FSSAI License / Registration in India (Form A, B, and C). CliniExperts team works as FSSAI consultants and has significant experience in assisting a range of Food industry players obtain the FSSAI Food License Registration that is appropriate to the size and nature of their business.

Frequently Asked Questions

I am a manufacturer of Milk and Milk Products. Do I need to submit a half-yearly Return?

W.e.f. FY 2020-21, FSSAI has ceased the filing of semi-annual returns (Form D2) for food businesses involved in manufacturing Milk and Milk Products. However, such food businesses are required to submit their Annual Returns (Form D1) through FoSCoS only.

Can multiple FSSAI license holders file a single annual return?

No, every FSSAI license holder is required to file a separate FSSAI annual return for every license they possess.

Who is exempt from filing the annual return according to FSSAI regulations?

As per FSSAI notifications, restaurants, fast-food establishments, canteens, and grocery stores are exempt from filing annual return.

Can I revise my annual return after submission?

Who needs to file the FSSAI Food Business Annual Return?

Every food business holding an FSSAI license must file the FSSAI annual return. This includes manufacturers, importers, relabellers, and repackers.